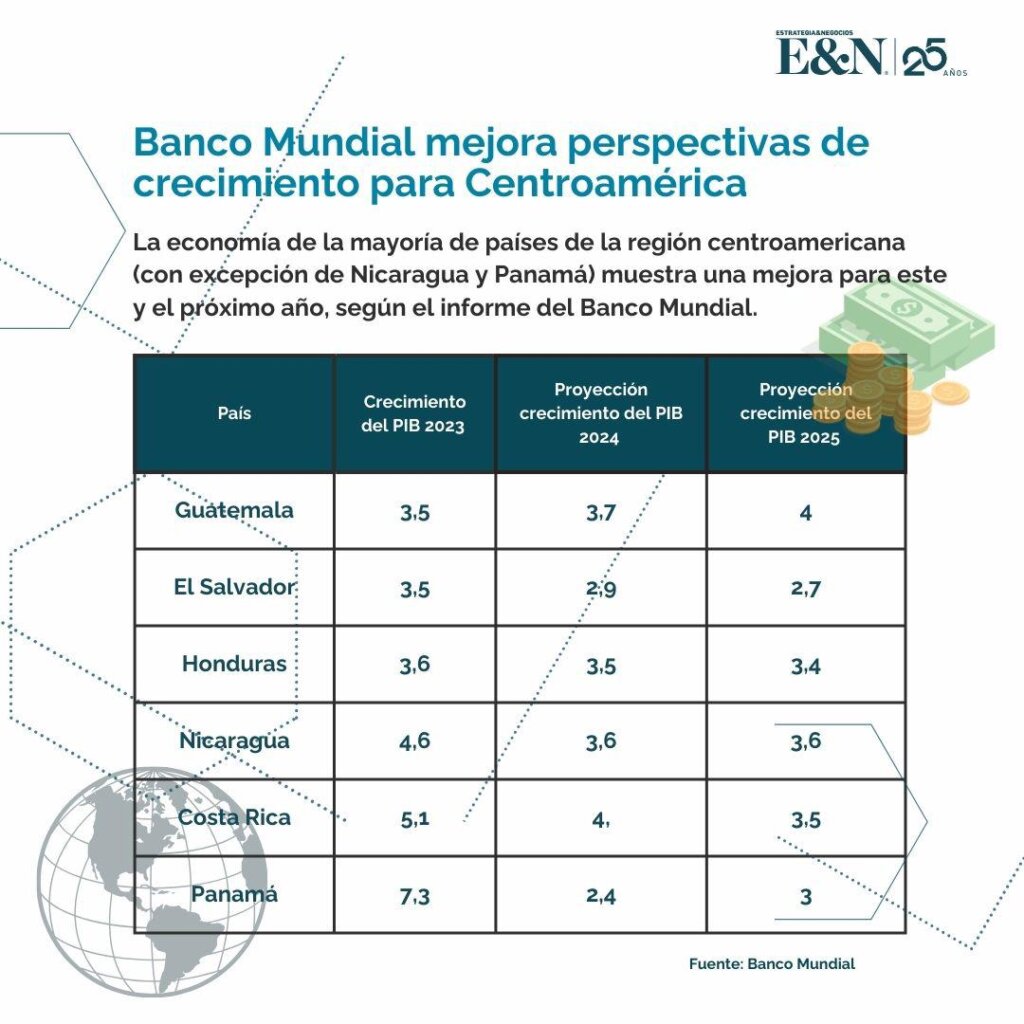

The World Bank report upgraded the Gross Domestic Product growth projection for the countries of the Central American region for 2024 and 2025, except for Panama and Nicaragua.

The World Bank raised economic growth projections for most Central American countries for 2024 and 2025.

According to the report “Taxing Wealth for Equity and Growth”, Latin America and the Caribbean will grow by 1.9% in 2024, slightly exceeding previous estimates, and in 2025 the region is expected to grow by 2.6%.

These are, however, the lowest rates among all regions in the world, highlighting persistent structural obstacles.

“The region has made progress in managing inflation and macroeconomic stabilization. This is a key moment to build on these achievements and attract the investments needed for sustainable development, foster innovation, build human capital, create more and better jobs, and empower the region to break free from this cycle of low growth,” said Carlos Felipe Jaramillo, World Bank vice president for Latin America and the Caribbean.

REGIONAL PROJECTION

In the specific case of Central American countries, the World Bank report projects that Costa Rica’s Gross Domestic Product (GDP) will grow 4 % this year and then drop to 3.5 %. Slightly higher than the 3.9% projected last April.

Then there is Guatemala, which would grow 3.7% and 4%, above the 3% that the WB had said; Honduras would grow 3.5% and 3.4%, slightly above the 3.4% estimated in April.

El Salvador’s GDP will grow 2.9% in 2024 and 2.7% in 2025, above the 2.5% estimated before.

On the other hand, the World Bank report indicates that Panama’s economy will grow 2.4 % and 3 %, below the 2.5 % previously estimated. Nicaragua also lowered its projection to 3.6% for both years, down from 3.7% previously.

To accelerate growth, the region must take advantage of the current economic dynamics. The U.S. Federal Reserve’s decision to lower interest rates is expected to provide some relief. Inflation control is another positive development, thanks to the effective macroeconomic management of the region’s countries.

The report highlights that public and private investment in Latin America and the Caribbean remains low, and that countries are not taking full advantage of nearshoring opportunities.

In real terms, foreign direct investment (FDI) is at lower levels than 13 years ago, and new investment announcements favor other regions. Despite having competitive wages compared to China and other destinations, high capital costs, weak education systems, poor energy and infrastructure, and social instability reduce the region’s attractiveness as a nearshoring destination.

Source: Revista E&N